total property tax in frisco tx

Collin County Tax Assessor-Collector Frisco Office. View details map and photos of this single family property with 2 bedrooms and 2 total baths.

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Taxes in Frisco Texas are 515 more expensive than Barberton Ohio.

. The minimum combined 2022 sales tax rate for Frisco Texas is. 20 County sales tax. Ad Call The Experts Today For A Speedy Answer To Your Property Tax Loan Questions.

Its Fast Easy. 6101 Frisco Square Boulevard. The tax rates are stated at a rate per 100 of assessed value.

Purefoy Municipal Center Frisco City Hall 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 Map. The sixth-most populous county in Texas Collin County also has the 15th-highest property taxes. Collin County Tax Assessor.

For Sale - 8589 Holly St Frisco TX - 300000. The total 8375 in sales taxes due within Town limits breaks down as follows. 825 Is this data incorrect The Frisco Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Frisco local sales taxesThe local sales tax consists of a.

Abbey Road Adolphus Drive Alamo Court Alden Lane Aldridge Drive Alexandria Drive Alfa Romeo Way Allendale Drive Alstone Drive Amber Valley Drive. Assumes a new 25000 Honda Accord and Sales Tax is amortized. Property Taxes 221.

When added together the property tax. Frisco as well as every other in-county public taxing unit can at this point compute required tax rates since market value totals have been recorded. Frisco City Council plans to maintain the citys property tax rate for fiscal year 2021-22.

Homes in Frisco Denton County Little Elm ISD. The latest sales tax rate for Frisco TX. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

Frisco City Council intends to keep the citys current property tax rate of 04466 per 100 valuation steady for the upcoming 2020-21 fiscal year. Property tax rate for city of frisco a tax rate of 0446600 per 100 valuation has been proposed for adoption by the governing body of city of frisco. The 2021 adopted tax rate for Frisco ISD is 12672.

Cost of Living Indexes. All Frisco ISD taxes are. As the planned growth plateaus in coming years can Frisco TX maintain its status as one of the best places to live in the US.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes. 20 Town sales tax to be remitted to the Town of Frisco.

Council members on Aug. Ad Call The Experts Today For A Speedy Answer To Your Property Tax Loan Questions. 29 State sales tax.

Ad OConnor Associates is the largest Property tax consulting firm in Texas. Interest Sinking Fund. Here is some information about the current Frisco property taxes.

The Texas sales tax rate is currently. Counties in Texas collect an average of 181 of a propertys assesed fair market. Property tax in texas is a locally assessed and locally administered tax.

Ad OConnor Associates is the largest Property tax consulting firm in Texas. 2022 Cost of Living Calculator for Taxes. Homes in Frisco Denton County Lewisville ISD.

Bear in mind that the figures above are only estimates based on the average Frisco homeowner. Property Taxes 220. Without skyrocketing property taxes for all the new residents.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. 9 set a proposed tax rate of 04466 per 100 property. Total Property Tax In Frisco Tx.

The combined tax rate is a combination of an MO tax rate of 09972 and an IS tax rate of 027. 2020 rates included for use while preparing your income tax deduction. Homes in Frisco Denton County Frisco ISD.

City of Frisco Total. Download a Full Property Report with Tax Assessment Values More. Property tax rate for city of frisco a tax rate of 0446600 per 100 valuation has been proposed for adoption by the governing body of city of frisco.

Collin County Tax Assessor Collector Office. The County sales tax rate is. This is the total of state county and city sales tax rates.

Plano Texas and Frisco Texas. This is driven largely by the high rates used to fund local school districts. This rate includes any state county city and local sales taxes.

Beautiful Corner Lot Property In The Sought After Frisco Isd This Home Boasts 4 Beds 3 Baths And 2 Car Garage The Ki New Home Construction Home Buying Home

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Beautiful Frisco Home Video Home Texas Homes House Styles

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What Is The Property Tax Rate In Frisco Texas

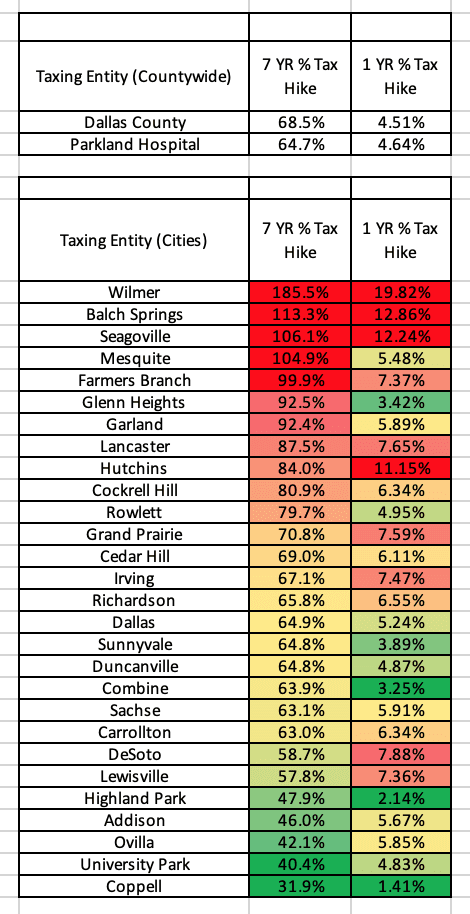

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Why Does Texas Have High Property Taxes Quora

/cloudfront-us-east-1.images.arcpublishing.com/dmn/GLBMMJHOFZED7FWOZG5BWEWOBY.jpg)

With Record Home Prices Dallas Fort Worth Property Owners Can Count On A Bigger Tax Bite

Why Are Property Taxes So High In Texas Here S 3 Reasons

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Why Are Texas Property Taxes So High Home Tax Solutions

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard